Another day, another data point showing the worst inflation in the history of a survey.

Today it’s the Richmond Federal Reserve Bank, which reports that prices paid to manufacturers surged twice as far as the prices they received. (Last week we had a similar report from the Philadelphia Federal Reserve Bank).

The cost of everything from raw materials to imported parts to labor is rising at the fastest rate on record.

The Richmond data only go back to 1997, to be sure, and the longer-dated Philadelphia survey shows inflation as bad in the past – but in every case, the widening gap between input costs and output prices led to recession.

Equity investors, nevertheless, believe what the Federal Reserve says rather than their own eyes, as Groucho Marx might have said – because the full impact of inflation will hit markets only if and when the Fed reacts to it. On Tuesday Fed Chair Jerome Powell insisted that there wasn’t any inflation, only some price increases as he told a Congressional committee:

A pretty substantial part, or perhaps all, of the overshoot in inflation comes from categories that are directly affected by the re-opening of the economy such as used cars and trucks. Those are things that we would look to to stop going up and ultimately to start to decline. I will say that these effects have been larger than we expected and they may turn out to be more persistent than we expected.”

Translated into English from the Fed Chair’s native dialect of Groucho: Even if inflation is higher and more persistent than we predict, we won’t do anything about it.

The market rose.

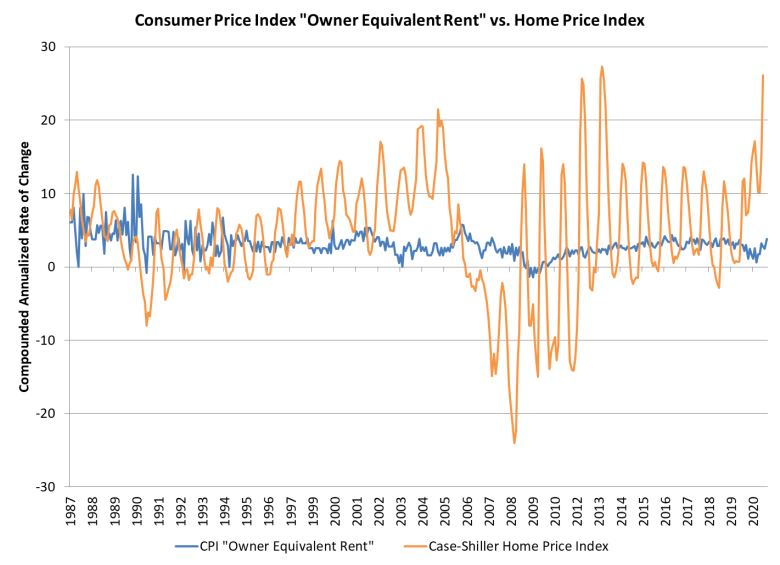

In fact inflation is much higher than the US Bureau of Labor Statistics claims, because bubbly home prices haven’t worked their way into the Consumer Price Index – yet.

We published this chart on June 10, but it bears a second look. Shelter is a third of the US inflation index, but that component of inflation barely has budged, despite nearly 14% year-on-year jump in home prices.

Auto prices are high and will remain high not because of Covid, but because the global semiconductor industry supply chain is broken – and it will remain so until sometime in 2023.

Durable goods prices apart from autos are rising (after falling for nearly twenty years in a row) because trillions of dollars of fiscal stimulus have created massive demand for imports.

Energy prices are rising because investment in US oil production has fallen by half since 2018.

This is endemic, persistent, demand-driven inflation created by the biggest fiscal stimulus in American history. The Fed can pretend it’s not there, or insist it won’t do anything about it – but not for very long.