The sugar high misrepresented as an economic recovery doesn’t entail any capital investment in industry, according to Bloomberg’s bottom-up survey of securities analysts. CapEx for the Industrials subsector of the S&P 500 Index will be about 30% below the 2019 level, the analysts’ project, and will still be 20% below the 2019 high water mark in 2022.

Americans face shortages of major consumer items like automobiles, home furnishings and computer displays. US imports from China are at an all-time high (the 12-month average as of June 2021 was up 14% over June 2019).

That’s because Americans can’t spend the $5 trillion in fiscal stimulus to date on American products, a supply-demand gap that has pushed inflation to its highest level in 30 years.

The Federal Reserve and President Joe Biden say that inflation is “transitory”, meaning supply will grow to match the bulge in demand. But where is the supply supposed to come from if manufacturers won’t invest?

Transportation costs are a major headache. According to the CASS Index, total freight traffic is up 4% from June 2019, but freight expenditures are up an astonishing 28%. The analysts surveyed by Bloomberg show falling investment in transportation as well.

Part of that can be blamed on shrunken airline traffic, but the major railroads will invest 15% less this year and next than they did in 2019.

The US energy sector, which contributed the lion’s share of CapEx during the shale boom of the early 2000s, is a shadow of its formal self, with an operating rig count about half the level of 2018.

Part of the problem is that US industrial companies aren’t making enough money. Return on Assets (ROA) for the sector is expected to fall to 2.75% this year, compared to 5.5% in 2019, and rise only slightly to 3.5% in 2022, according to the Bloomberg data.

That should be no surprise: Every survey of goods-producing businesses shows that the cost of inputs is rising much faster than the price of finished goods, so manufacturers’ margins are squeezed.

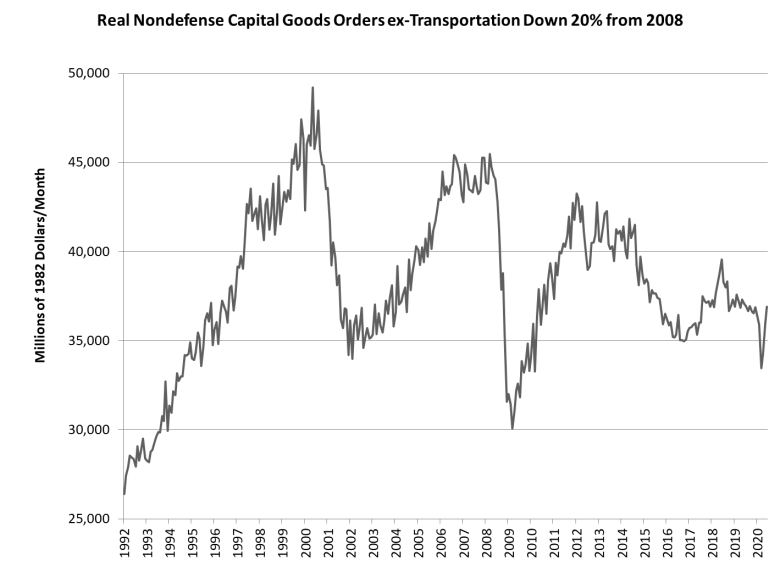

The same miserable state of capital investment is evident in Census Bureau data on orders for capital goods (excluding defense goods and transportation).

After adjusting for inflation using the Producer Price Index for capital goods, US equipment orders are 30% below the 1999 peak and 20% below the 2008 peak. Overall, capital goods orders have fallen to levels last seen in 1995.

American companies have lost interest in manufacturing. Only 6% of American undergraduates major in engineering. Working-class communities that used to provide skilled manufacturing labor have disintegrated.

American supply chains have eroded. Tax breaks for capital spending and R&D are threadbare compared to America’s competitors. And virtually all the rewards in the equity market for the past dozen years have accrued to software companies.

President Trump’s tariffs against China and President Biden’s “Made in America” executive order have had no noticeable impact on the continuing deterioration of US manufacturing. It’s cheaper and easier to buy from Asia than to make things in America.